Recent Articles

50-Year Mortgages? Here’s What You Need to Know

The Trump administration says it’s exploring 50-year mortgage options to help with affordability. Learn what this could mean for homebuyers, monthly payments, and long-term costs.

Published on 11/11/2025

Hybrid STR Investor Loan Guide Smarter Financing for Airbnb and Vacation Rental Investors Powered by Vision One Mortgage | NMLS #7861

Unlock Better Financing for Your Short-Term Rental Investments Your Airbnb deal shouldn’t die in underwriting. Discover how hybrid STR investor loans help you qualify using real booking revenue — even when traditional DSCR math says “no.” [Download Your Free Guide] (CTA button) Get the insider playbook for STR financing — built for investors who want smarter leverage, lower down payments, and entity-friendly structures.

Published on 11/08/2025

Fannie Mae’s Big Update: You May Qualify Even With a Credit Score Below 620

Fannie Mae’s new credit score policy lets lenders use automated approvals even for borrowers below 620. Here’s what that means for homebuyers who thought they couldn’t qualify.

Published on 11/08/2025

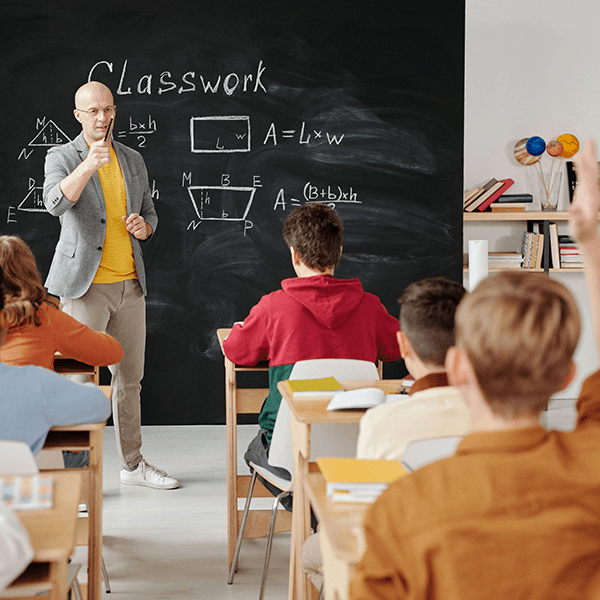

What’s Going On With Mortgage Rates? (Explain-It-to-a-5th-Grader Version)

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

Published on 11/06/2025

How do reverse mortgages stack up against other financial options?

While traditional refinancing and home equity loans require steady income and monthly payments, a reverse mortgage offers a flexible alternative for homeowners 62 and older. It provides access to home equity that can supplement retirement income, cover unexpected expenses, or eliminate existing mortgage payments — all while you continue living in your home.

Published on 10/30/2025

Why did mortgage rates go up even though the Fed cut rates?

Because the Fed controls short-term rates, not mortgage rates. Mortgage rates follow the bond market — and if investors think inflation might rise or the economy’s still strong, long-term rates (and mortgage rates) can actually move higher even after a Fed cut. #MortgageRates #FedCut #RealEstateTips #HomeLoans #VisionOneMortgage #MarketUpdate #Mortgage101

Published on 10/29/2025

Mortgage Rates Jump After the Fed’s Rate Cut — Here’s Why

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

Published on 10/29/2025

Mortgage Rates Jump After the Fed’s Rate Cut — Here’s Why

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

Published on 10/29/2025

Mortgage Rates Jump After the Fed’s Rate Cut — Here’s Why

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

Published on 10/29/2025